|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

How to Repair Credit on Your Own

In today's world, credit scores have become a pivotal aspect of financial health, akin to a financial report card that influences your ability to borrow money, rent an apartment, or even secure a job. Thankfully, repairing your credit is not only possible but entirely feasible on your own with some diligence and patience. Let's explore how you can take charge of your financial future by repairing your credit score yourself.

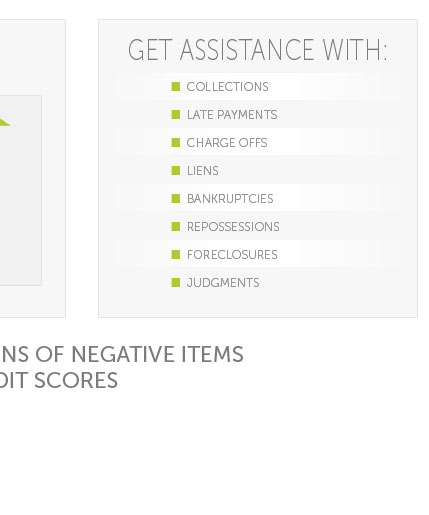

Understanding Your Credit Report: The first step in repairing your credit is understanding what's on your credit report. You are entitled to a free report annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Scrutinize these reports meticulously, looking for inaccuracies or outdated information that could be unfairly dragging down your score. Common errors might include incorrect personal information, accounts that don't belong to you, or wrongly reported late payments. If you find any discrepancies, you can dispute them with the credit bureau, and they are legally obligated to investigate.

Crafting a Budget: Once you've ensured your credit report is accurate, the next step is creating a realistic budget that helps you manage your debt effectively. A well-crafted budget serves as a roadmap, guiding you towards financial stability and ensuring that you live within your means. By prioritizing essential expenses and cutting down on non-essential spending, you can allocate more funds towards paying off existing debts, which is crucial for improving your credit score. Remember, the goal is to pay more than the minimum on your credit cards to reduce your balance quickly, thereby enhancing your credit utilization ratio.

Dealing with Debts: If you find yourself overwhelmed by multiple debts, consider the debt avalanche or debt snowball methods. The debt avalanche method involves paying off debts with the highest interest rates first, while the debt snowball method focuses on paying off the smallest debts first. Both strategies have their merits, and your choice depends on what you find more motivating-saving on interest payments or seeing debts eliminated quickly. Whichever method you choose, consistency is key.

Building Positive Credit Habits: As you work on reducing your debt, it's equally important to establish positive credit habits. This includes paying your bills on time, keeping credit card balances low, and avoiding taking on unnecessary new credit. If you find it challenging to remember due dates, setting up automatic payments can be an excellent way to ensure timely payments. Additionally, consider using a secured credit card if you are struggling to qualify for a traditional one, as these can be an effective tool for rebuilding credit when used responsibly.

Patience and Persistence: Repairing credit is not an overnight process, and it requires both patience and persistence. As you implement these strategies, your credit score will gradually improve over time. It's important to monitor your progress by checking your credit score periodically, which can help you stay motivated and make adjustments to your strategy if needed.

The Long-Term View: Repairing your credit on your own can be an empowering journey, leading to greater financial freedom and opportunities. By understanding your credit report, managing your debts wisely, and cultivating healthy financial habits, you can not only improve your credit score but also gain confidence in managing your finances. Remember, the effort you invest today in repairing your credit will pave the way for a more secure and prosperous future.

- Review credit reports annually.

- Create and stick to a budget.

- Use debt payoff strategies.

- Develop positive credit habits.

- Be patient and persistent.

In conclusion, while the task of repairing credit might seem daunting at first, it is indeed achievable with the right mindset and approach. By taking proactive steps, you can steer your financial life in a positive direction and enjoy the many benefits that come with a strong credit score.

Check Your Credit Report - Improve Your Payment History - Know Your Credit Utilization Ratio - Consider How Many Credit Accounts You Have - Think ...

How do credit scores work? - How to fix your credit score - Step 1: Obtain and review your credit reports - Step 3: Focus on payment history - Step ...

Write letters to the credit bureau and the business that reported the information about you. Use these sample ...